6/12/2006

Focusing on Customer Retention to Deliver Significant ROI

SEDONA CRMTM

SEDONA® Corporation is a provider of verticalized CRM application and services specifically tailored for small to midsize organizations.

SEDONA's CRM application, Intarsia, unlike horizontal, general-purpose CRM applications, has the specificity required by any line of business within an organization. This enables them to maximize their return on investment and lower their cost of ownership.

Intarsia effectively delivers on the ultimate goal of customer relationship management - increasing the profitability of a company's customer portfolio.

Case Study: Suburban Bank

(Please note that the actual bank name is changed to maintain confidentiality and privacy of the institution. However, the data does represent an actual bank and was gathered from the Thomson Banking Directory.)

- Assets: $219 million

- Income: $2.537 million

- Accounts: 13,016

- Customers: 10,000 (estimate)

Where Does Profit Come From?

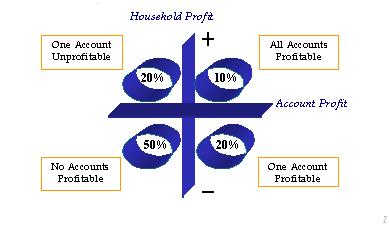

The following diagram depicts the segmentation of a financial services organization customer base into four groups according to standard industry statistics on household and account profitability.

As shown above, industry statistics indicate that 10% of a financial services organization's customer households are households where every single account owned is profitable, while 50% of them are households where every single account is not profitable.

It is extremely important that Suburban Bank focus first and foremost on that most profitable 10% of customer households.

Measuring Householding Profitability

Using Intarsia's comprehensive set of marketing analytics capabilities, Suburban Bank ran one of the many standard reports provided with Intarsia, which broke its customers' households into groups of 10% ("deciles") and ranked them based on their profitability, revealing the following comparison of profit to accounts per household (cross sell ratio):

|

DECILE |

PROFIT PER DECILE |

AVERAGE HOUSEHOLD PROFIT |

NUMBER OF HOUSEHOLDS |

NUMBER OF ACCOUNTS |

ACCOUNTS PER HOUSEHOLD |

|

1 |

$3,783,682 |

$6,930 |

546 |

2,015 |

3.69 |

|

2 |

$430,275 |

$788 |

546 |

1,469 |

2.69 |

|

3 |

$115,941 |

$212 |

546 |

1,207 |

2.21 |

|

4 |

($7,865) |

($14) |

546 |

895 |

1.64 |

|

5 |

($69,006) |

($126) |

546 |

868 |

1.59 |

|

6 |

($107,315) |

($197) |

546 |

792 |

1.45 |

|

7 |

($147,400) |

($270) |

546 |

803 |

1.47 |

|

8 |

($209,810) |

($384) |

546 |

1,207 |

2.21 |

|

9 |

($340,719) |

($624) |

546 |

1,534 |

2.81 |

|

10 |

($910,783) |

($1,668) |

546 |

2,211 |

4.05 |

|

Total/Average |

$2,537,000 |

$465 |

5,460 |

13,000 |

2.38 |

The above information shows that the top 10% of Suburban Bank customer households generated $3,783,682 in profits last fiscal while the overall profitability of the bank in the same year was $2,537,000. Each of those customer households therefore, on average, is worth $6,930.00 each year. Understanding and focusing on these customers can make a critical difference in Suburban Bank's success.

Customer Retention Increases Profitability

Using Intarsia as the technology for the management of the relationships and interactions of its customers, Suburban Bank has the ability to combine a strong customer service culture with the knowledge of which customers are most important to retain. Unlike other systems on the market, Intarsia allows you to capture and share information about each "touch" or contact with a customer in combination with the back office customer data aggregation and analytics (customer, product & household profitability, segmentation, customer retention prediction and next best product identification). This enables Suburban Bank's entire organization to have the necessary information to properly service customers and make appropriate sales, service and marketing decisions.Suburban Bank's goal of increasing customer retention of its most profitable customer households (first decile) by 6% will yield an annual profit increase of $227,027 (this result is calculated by taking 10 percent of 5,460 households, or 546, and multiplying that by the average first decile household profit of $6,930, and then taking 6% of that total).

Considering that the total first year cost of Intarsia, based on Suburban Bank's total asset value, is $40,400*, the investment on acquiring SEDONA's CRM application solution is easily justified by the immediate revenues it can generate by simply focusing on customer retention - an ROI of 562%.

Examining customer profitability and cross sell opportunities is just one of many ways that Intarsia can increase a financial institution's overall profitability and maximization of return on investment. Matching the needs of the specific client and their business objectives, Intarsia can provide a wide range of information and capabilities to enable a better understanding and overall improved management of existing and prospective customers.

*Intarsia pricing is based on size of the institution, partner selling and supporting and overall implementation costs. $40,400 is used as an example only.